Thank you for considering a gift to Habitat for Humanity Sarnia/Lambton as part of your long-term financial and estate planning. There are many ways to support Habitat for Humanity and our mission here in Sarnia and Lambton County.

Habitat for Humanity Sarnia/Lambton is a charitable organization that builds decent, affordable homes and then sells them to low-income families for a $0-down, 0%-interest, 20-year, Habitat-held, mortgage with geared-to-income monthly payments. 100% of the mortgage revenue we receive each year is used to build more homes for more local families. Proceeds from our Sarnia ReStore pay for 100% of our administrative and operational costs. For this reason, 100% of every dollar donated to Habitat Sarnia/Lambton is used to build homes.

Research undertaken amongst Habitat families nationwide shows that, upon receipt of a Habitat home, children’s academic performance improves, families are healthier and become more vested/involved in their communities. Every $1 invested in Habitat for Humanity yields a $4 Social Return on Investment (SROI).

With thanks and appreciation for content used with the permission of RBC Dominion Securities and The Anglican Church of Canada.

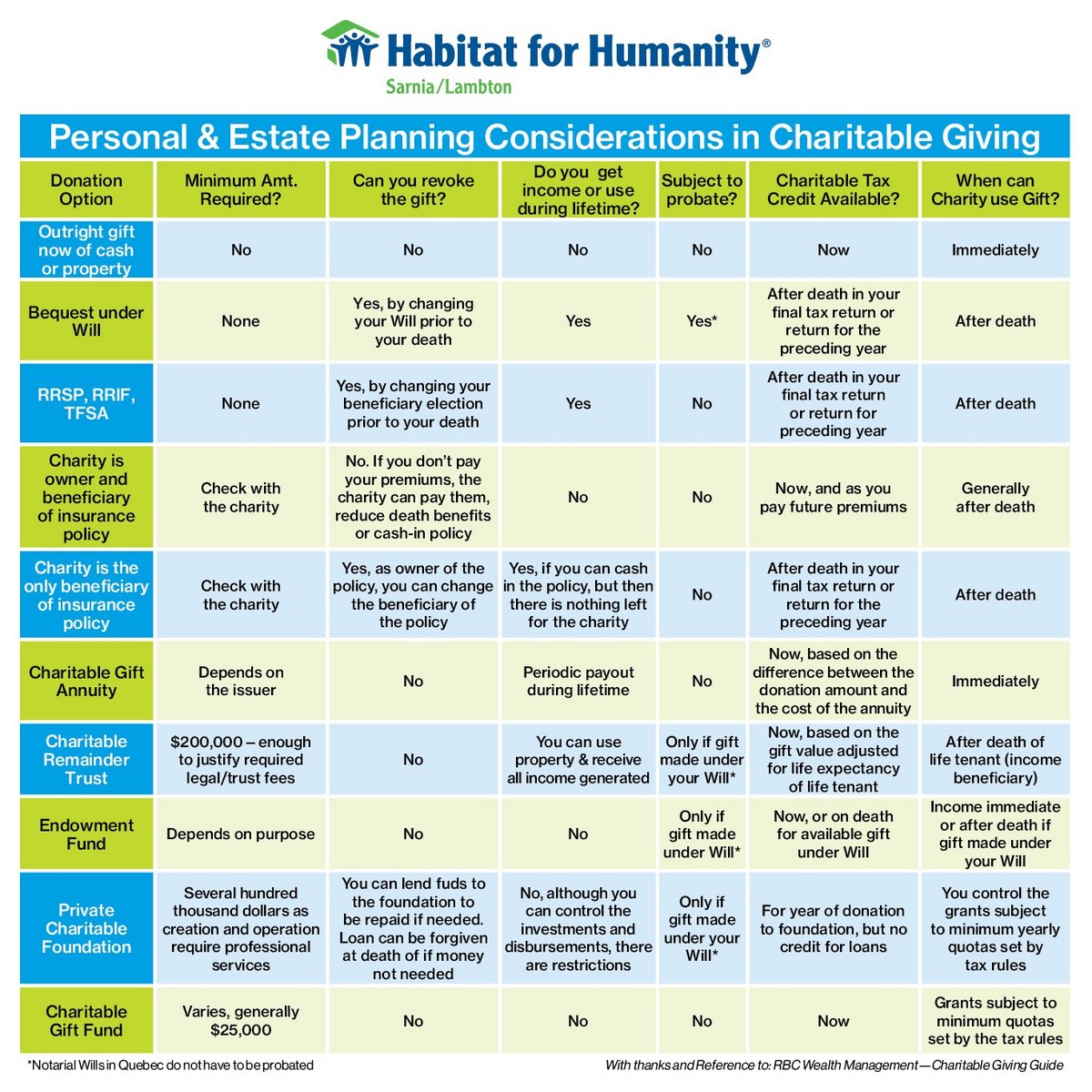

The chart below showing options for Personal & Estate Planning Considerations in Charitable Giving is a great place to start. Once you have a sense of the kind of planned gift(s) you would like to pursue, then the information that follows the chart will provide additional detail.

Disclaimer: There are numerous options when considering legacy gifts. Habitat for Humanity Sarnia/Lambton encourages you to consult with your legal and financial advisors regarding current income tax provisions and all issues relevant to your personal circumstances.

It is a simple process to add Habitat for Humanity Sarnia/Lambton as one of the beneficiaries to your RRSPs, RRIFs or TFSAs. Since such gifts are ‘deferred’ – or paid after you die – designating Habitat Sarnia/Lambton in your RRSP, RRIF or TFSA will not jeopardize your own future financial stability. And, your estate will benefit from the tax credits.

Retirement funds that you no longer need can have a tremendous impact when donated to Habitat Sarnia/Lambton. Your estate will receive a receipt to offset taxes due from the distribution of the RRSP, RRIF or TFSA, which are among the most heavily taxed assets you own.

These plans do not form part of the estate assets that require probate, as long as there is a named beneficiary. As such, naming Habitat Sarnia/Lambton as the beneficiary of your registered plan may result in significant savings where the fee is charged on the value of the estate. A beneficiary designation can be made directly on the RRSP, RRIF, or TFSA application form and can only be changed by the annuitant.

Life insurance is often something we don’t wish to think about, yet it can be a creative way to provide for your loved ones and heirs whilst still making a donation to a charitable cause that is important to you. Want to know more?

DOWNLOAD information on Life Insurance

Disclaimer: There are numerous options when considering legacy gifts. Habitat for Humanity Sarnia/Lambton encourages you to consult with your legal and financial advisors regarding current income tax provisions and all issues relevant to your personal circumstances.

Your Last Will & Testament is the cornerstone of estate planning, yet less than 50% of Canadians have a legal Will in place. If you die intestate (or without a legal Will) then the government will determine how your estate will be disbursed. When that happens, the government does not select charitable organizations as beneficiaries. If you wish to ensure that a charitable organization – like Habitat Sarnia/Lambton – receives a portion of your estate then it is important that you have a legal Will in place. Want to know more?

![]()

DOWNLOAD information on Charitable bequests

Besides Wills, life insurance and securities, you may also choose to donate a retirement fund. Or you may wish to use assets to complete an outright gift of cash…or to establish an endowment in our name or that of a loved one.

A Major Gift

When you make an ‘outright’ gift of cash or property to Habitat Sarnia/Lambton, 100% of your donation is used to build homes for families right here in Sarnia and Lambton County. Your ‘outright’ gift gives you the satisfaction of seeing the results of your donation and knowing that the lives of local families are being transformed with your help.

The Canada Revenue Agency’s (CRA) charitable donation tax credit means that your gift is worth more to Habitat Sarnia/Lambton than its actual net cost to you. Each year, a percentage of the value of your accumulated donation receipts – 15% of the first $200, then 29% thereafter – can be subtracted from the federal income tax that you owe. Your provincial taxes will also be reduced. Depending upon current tax law, the combined savings could be as much as 53.53% of your contribution. You can claim eligible amounts of gifts to a limit of 75% of your net income.

In any one year you may claim:

- Donations made by December 31 of the applicable tax year

- Any unclaimed donations made in the previous five years

- Any unclaimed donations made by your spouse or common law partner in the year or in the previous five years

A cheque is considered to have been given on the day it was mailed and a gift by credit card on the date the obligation was incurred.

To review your potential charitable tax credits for a gift, you can use the Charitable Donation Tax Credit Calculator found on the Canada Revenue Agency’s (CRA) website.

Endowment Funds

Endowments increase in value over time, creating an enduring and vibrant legacy. You can establish your personal endowment fund with a one-time donation, a pledge over time, or through a bequest in your Will. Your fund can be in your name, your family’s name, or you can honour a loved one.

Your named endowment fund can be established to support a specific Habitat build or you may allow us to use the funds where they are most needed. Endowment funds will be invested by Habitat for Humanity Sarnia/Lambton and, unless otherwise specified, the investment income will be used to support the programs that we offer that are most important to you, for generations to come.

A minimum of $25,000 is required to set up a named endowment fund. However, it is possible to establish the fund with a gift of $5,000 and pay the balance over the following four-year period.

Wondering What to Give?

We understand the financial demands facing you today. The following proportionate gift guideline may help you make your pledge decision.

All gifts are eligible for tax receipts. The indicated savings shown in the chart below are guidelines only and will vary based on individual circumstances. The guideline is also based on the maximum credit available after the first $200 in donations.

Finding land upon which to build is one of Habitat Sarnia/Lambton’s biggest challenges. A gift of real estate enables you to make a bigger charitable difference than you may have thought possible. It also helps you to avoid estate taxes and minimizes or eliminates any burden placed on your heirs.

Gifts of real estate range from personal residences and vacation homes, to rental properties, farmland and commercially developed land. You may choose to donate real estate outright and receive an immediate tax credit, or to retain the property for use during your lifetime and make it a ‘planned gift’ in the form of a Gift of Residual Interest.

We encourage you to speak to your lawyer or financial planner to determine how your real estate holdings can best be utilized to meet both your charitable goals and financial needs.

Disclaimer: There are numerous options when considering legacy gifts. Habitat for Humanity Sarnia/Lambton encourages you to consult with your legal and financial advisors regarding current income tax provisions and all issues relevant to your personal circumstances.

This is a tax-efficient way to donate. If you sell a stock or bond privately, you are currently taxed on 50% of the capital gains. However, if you gift that security directly to Habitat Sarnia/Lambton, all taxable capital gains are eliminated and you will receive a tax receipt for the full market value of the security on the day that it is received by Habitat. Want to know more?

![]() DOWNLOAD information on gifting Publicly Traded Securities

DOWNLOAD information on gifting Publicly Traded Securities

Gift annuities are a way that Canadians who are 60 years of age and older can make a gift to help fund Habitat Sarnia/Lambton’s mission work while still receiving a guaranteed annual income for life, the majority (or all of which) is tax-free. These are truly gifts that give back. And they are a simple way for those who depend on a consistent income stream while they are living, to leave a substantial legacy after they die. Want to know more?

![]() DOWNLOAD FAQ’s on Gift Annuities and other information

DOWNLOAD FAQ’s on Gift Annuities and other information

Many people wish to leave a gift to Habitat Sarnia/Lambton, but also want to ensure that the needs of a dependent child or spouse are provided. You can establish a living trust by contributing cash or other property. When you do, the benefit is an immediate tax deduction during your lifetime, rather than to your estate after your death. You or your family member receive income for life from the trust, and the “remainder” would pass directly to Habitat Sarnia/Lambton after your death.

This includes works of art, books, household furnishings, automobiles, equipment and collections. If you have objects in good condition containing significant value but which are no longer of value to you, this type of gift is a possibility.

Depending on the value of the asset, such a gift to Habitat Sarnia/Lambton may require a signature to a legal document that transfers ownership. Opinions may be needed regarding the object’s origins, history and chain of title/ownership. In addition, an appraisal by a qualified appraiser will be required from you, as the donor, as well as one by Habitat.

Disclaimer: There are numerous options when considering legacy gifts. Habitat for Humanity Sarnia/Lambton encourages you to consult with your legal and financial advisors regarding current income tax provisions and all issues relevant to your personal circumstances.